Understand each tax form in depth with useful examples, detailed requirements, and instructions for filing out the forms to make your filing stress-free.

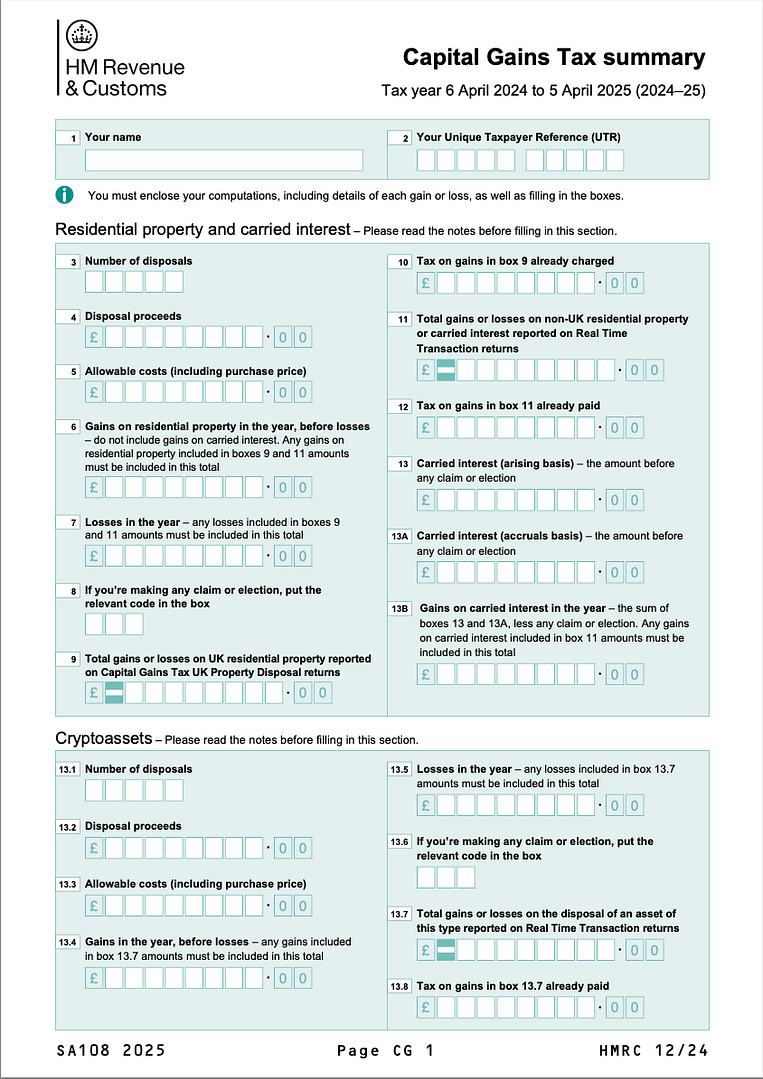

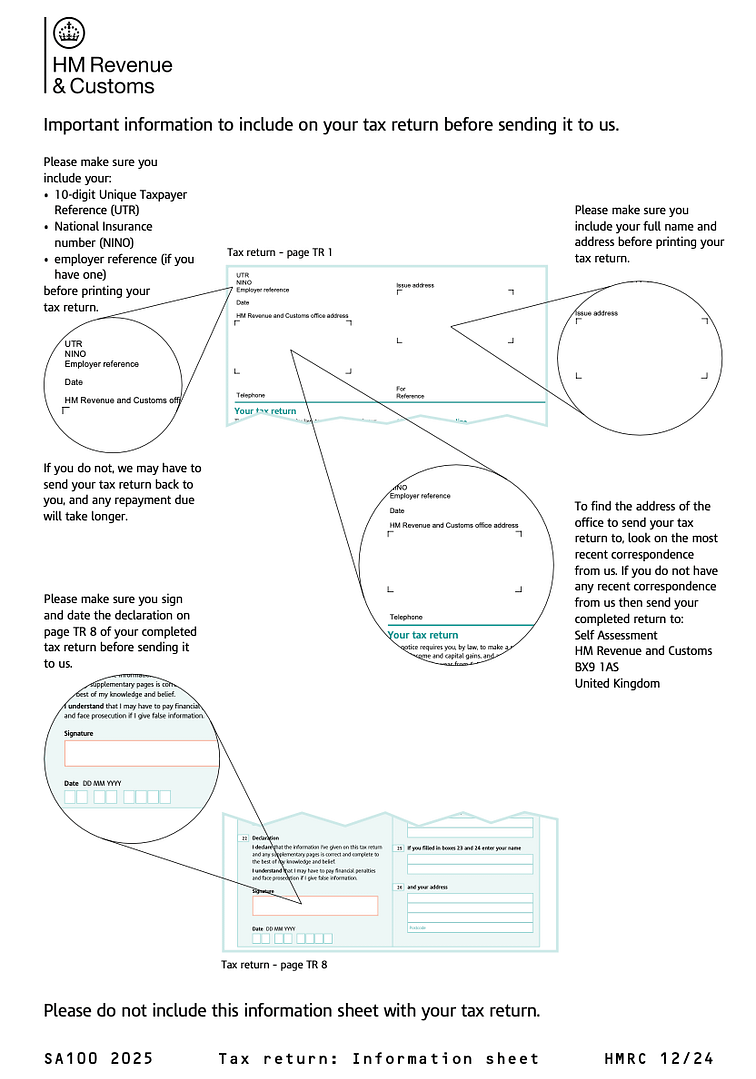

SA100 Form

If you earn income outside your main job, use the SA100 form to declare untaxed earnings.

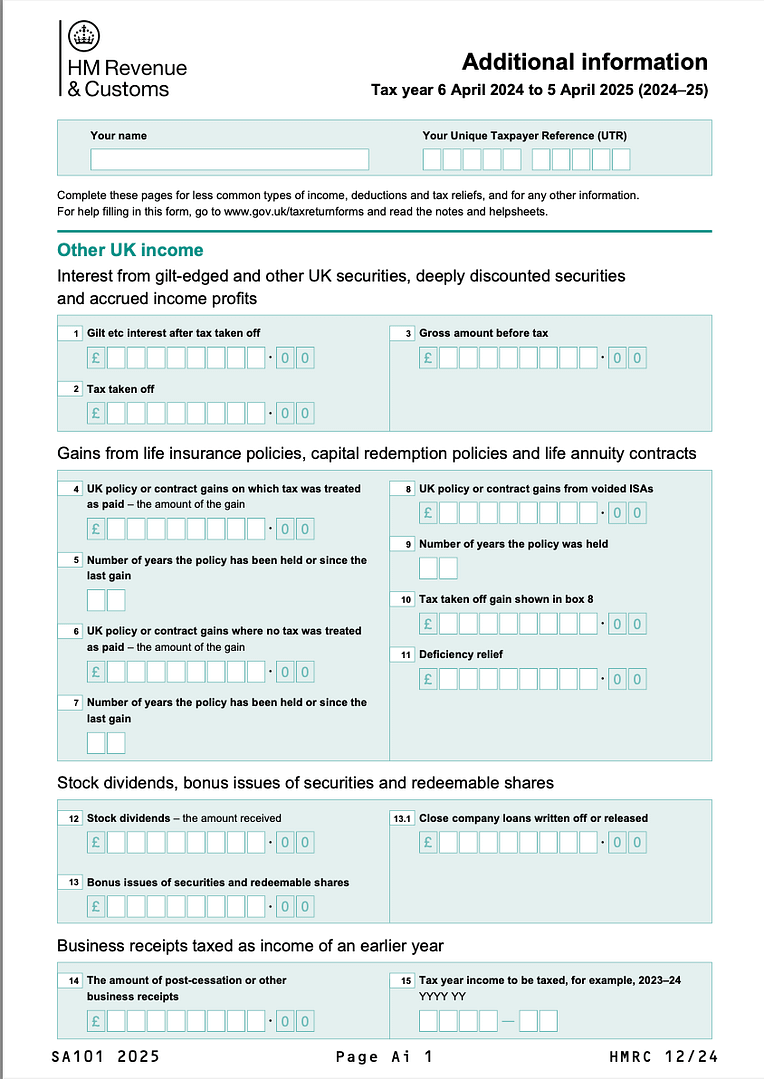

SA101 Form

Find out what counts as ‘special income’ on the SA101 and when to include it in your tax return.

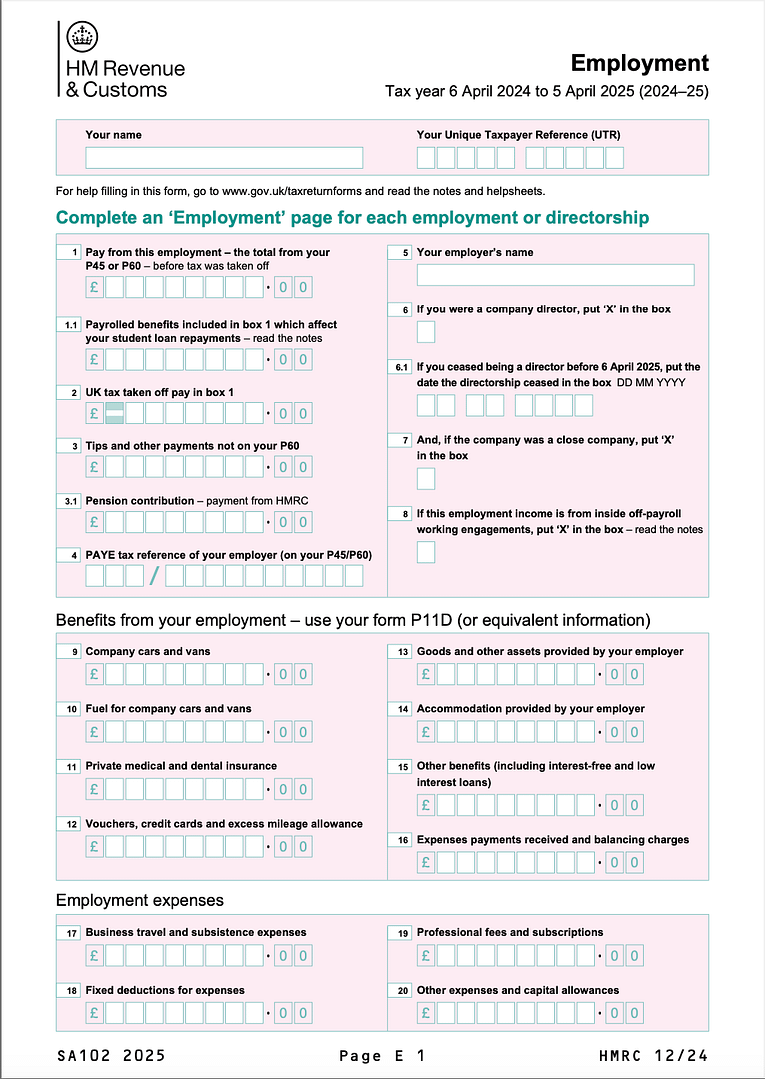

SA102 Form

Paid through PAYE (from a job or as a director)? Use the SA102 to enter your pay, tax deducted, and any benefits (P60/P11D).

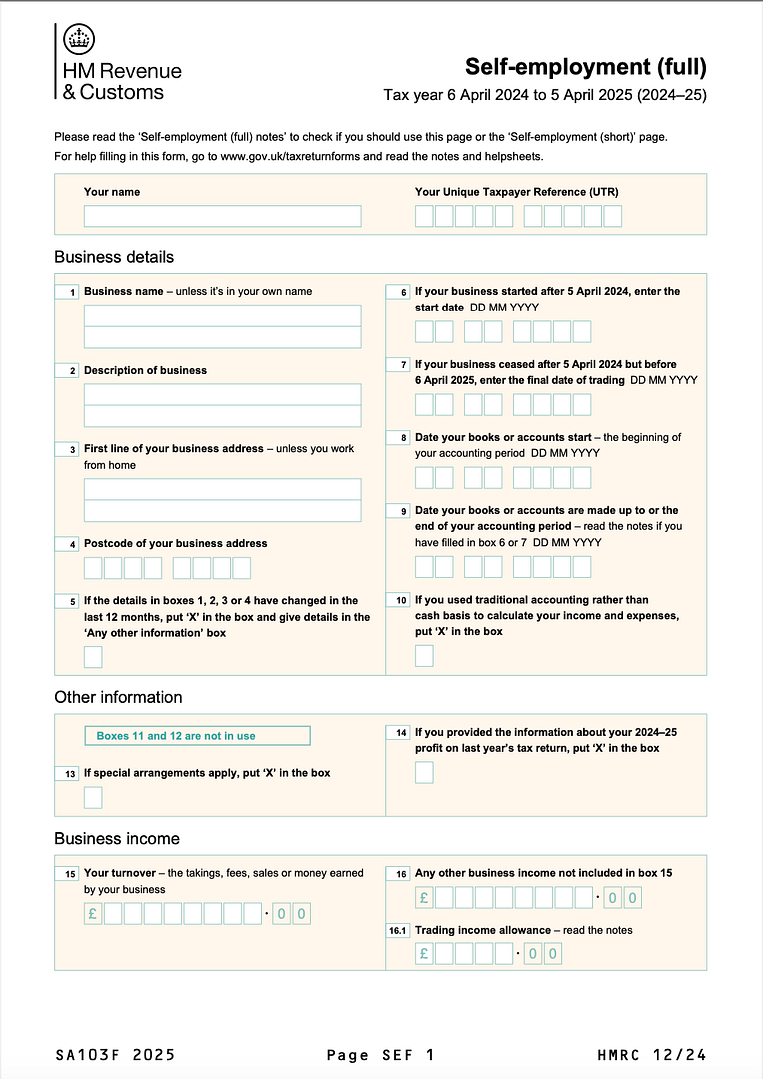

SA103 Form

Self-employed as a sole trader? Use the SA103 to declare business income, expenses, and profit for Self Assessment.